Psychology of Money: Understanding Behavior for Financial Success

Understanding the Psychology of Money: Why Your Brain Is Your Greatest Financial Asset

Money isn’t just numbers in a spreadsheet—it’s emotions, memories, beliefs, and identity. This truth sits at the heart of the psychology of money, a field that examines how our subconscious patterns, behaviors, and emotional triggers shape the way we earn, spend, save, and invest.

Too often, we assume financial success is about knowledge or income. But behavioral science tells a different story: mindset and habits drive long-term financial results more than raw income does. If you’re serious about achieving wealth and financial well-being, understanding your inner money narrative is the place to start.

In this guide, you’ll explore how your past shapes your present financial choices, how to recognize and overcome limiting beliefs, and how to rewire your habits using proven psychological strategies.

Key Takeaways:

- Your money mindset profoundly influences every financial decision you make—from saving to investing to spending.

- Early childhood experiences lay the groundwork for how you view scarcity, risk, and self-worth related to money.

- You can reshape your beliefs and develop empowering financial habits using behavioral tools and intentional strategies.

- Understanding your financial psychology is a foundational step to successful budgeting, debt payoff, and wealth building.

Curious about the subconscious money beliefs that may be sabotaging your goals? Explore the 7 money beliefs that keep people broke (and how to break them).

The Role of Psychology in Finances

Most personal finance advice emphasizes spreadsheets and savings formulas—but the real challenge isn’t arithmetic. It’s behavior. That’s where psychology comes in. Behavioral economists like Daniel Kahneman and Richard Thaler have shown how emotions and cognitive biases cause people to act against their best interests—even when they know better.

Think about it: why do we avoid budgeting even when we know it works? Why do we keep credit card debt despite paying high interest? Why do we spend impulsively when we’re stressed? These aren’t math problems. They’re mindset problems.

Understanding the psychology of money means recognizing the internal forces that drive our habits:

- Loss aversion: We fear losing money more than we value gaining it.

- Instant gratification: Our brains prefer short-term pleasure over long-term benefit.

- Confirmation bias: We seek information that justifies our existing beliefs, even when they’re harmful.

Financial literacy is important—but financial self-awareness is transformational. Learn how to rewire your brain for wealth by aligning your mindset with intentional, evidence-based strategies.

How Mindset and Behavior Affect Financial Decisions

.jpg_01.jpeg)

Your money mindset is the internal story you tell yourself about what money means—and whether you believe you’re capable or deserving of having it. This internal narrative is often shaped by past trauma, social influences, or even inherited beliefs from your family system.

For instance, many people engage in retail therapy to cope with stress, only to feel guilt later. Others avoid checking their bank accounts due to anxiety or fear. These patterns create cycles that drain wealth and self-confidence.

Practical tools like mindfulness, journaling, and emotion tracking can help interrupt these automatic behaviors. Combined with a practical system—like a values-based budgeting method that works—you can shift toward conscious, empowered decision-making.

Over time, small mindset shifts lead to massive financial outcomes. You don’t need to be perfect—you need to be consistent, aware, and ready to change what no longer serves you.

Common Money Mindsets That Influence Financial Behavior

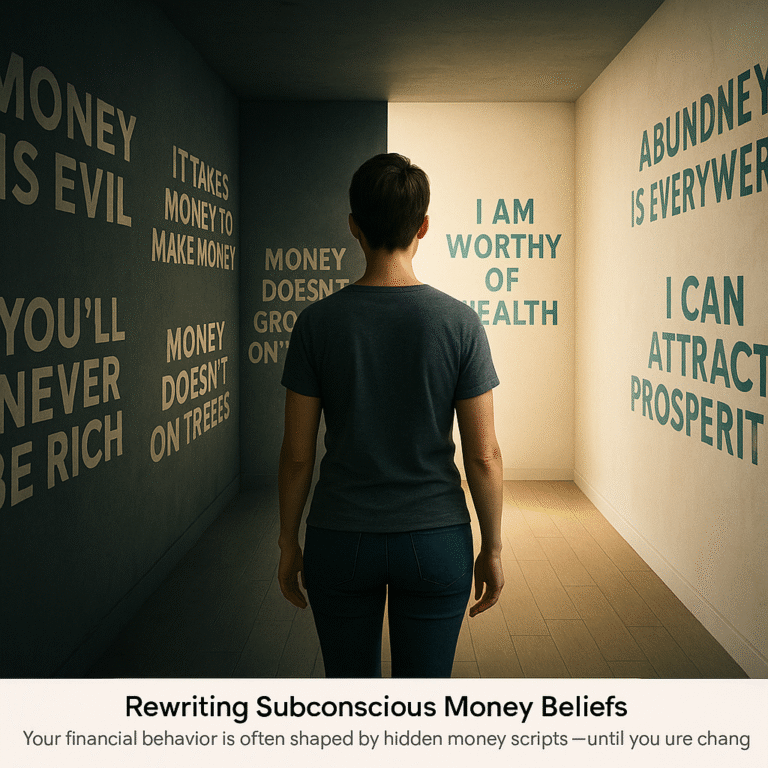

Your financial behavior doesn’t start with your bank account—it starts with your beliefs. These beliefs, often called money mindsets or “money scripts,” influence how you handle earning, spending, saving, and investing. These mindsets develop early and often go unchecked into adulthood.

Some of the most common money mindsets include:

- Scarcity mindset: The belief that there’s never enough, leading to hoarding or risk-avoidance.

- Abundance mindset: The belief that money flows freely and opportunities are always available.

- Money avoidance: Viewing money as evil or a source of stress, often leading to neglecting finances.

- Money worship: Believing more money will solve all problems, often driving overspending or overworking.

By identifying your dominant money script, you gain clarity on the invisible rules you’ve been living by. And with awareness, you can begin to rewrite those scripts. For a deep dive into reshaping limiting beliefs, explore the article: 7 Money Beliefs That Keep You Broke.

Rewriting your mindset won’t happen overnight, but it begins with recognizing that your current money behaviors are rooted in stories—and you have the power to tell a new one.

How Childhood Experiences Affect Financial Behavior and Mindset

Your earliest interactions with money form the blueprint for how you manage (or mismanage) it today. As children, we absorb unspoken messages from our caregivers and environment—many of which get stored as financial habits, fears, or compulsions.

Consider the following early money experiences:

- Were your parents frugal, anxious, or extravagant with money?

- Was money a taboo topic—or constantly a source of stress and conflict?

- Did you experience scarcity, or were your basic needs always met?

These experiences shape your adult tendencies: fear of investing, anxiety about spending, overspending for status, or under-earning due to self-worth issues. By reflecting on these origin stories, you gain the power to update them.

Action Step: Journal your first memory of money. What emotion was tied to it—fear, pride, shame, joy? Then ask yourself: “Does this belief still serve me?”

To move forward, you must first understand where you’ve been. For support, revisit our full guide on understanding your financial behavior.

Breaking Negative Financial Habits for a Healthier Money Mindset

Negative financial habits like emotional spending, avoidance of budgeting, or credit dependence are often coping mechanisms—responses to unprocessed emotions or past conditioning. The good news? Habits can be broken. But first, they must be understood.

Use this three-step process to begin shifting:

- Identify the trigger: What emotion, event, or stressor typically precedes the behavior?

- Interrupt the pattern: Use tools like the 24-hour rule, budgeting apps, or financial journaling to pause and reflect.

- Replace the response: Instead of impulse buying, channel that energy into a money goal, a walk, or calling a friend.

This is the heart of cognitive restructuring—replacing “I deserve this” with “Will this purchase get me closer to financial freedom?” Small shifts lead to powerful behavior change.

Need help building new systems? Start by designing a realistic, values-aligned plan using this step-by-step guide to budgeting.

Strategies to Shift Your Money Mindset and Make Better Financial Decisions

Shifting your money mindset isn’t about positive thinking alone—it’s about consciously reprogramming your beliefs, habits, and triggers to align with long-term success. Whether you’re stuck in scarcity mode or constantly sabotaging savings goals, small mental and behavioral shifts can yield lasting change.

Here are proven strategies to help you reset your relationship with money:

- Practice gratitude: Reflect daily on what you already have. Gratitude reduces impulse spending and reframes scarcity thinking.

- Set emotionally charged financial goals: Go beyond “save more.” Try “Save $5,000 to travel with my partner next summer.” Attach meaning.

- Use visual reinforcement: Tools like progress trackers, debt payoff charts, or vision boards help your brain “see” success.

- Take a pause: Use the 24-hour rule before purchases over $50 to reduce reactive decisions.

- Invest in financial education: Read books, take courses, or explore guides like Debt Snowball vs. Avalanche to empower smarter decisions.

Over time, these small strategies create new neural pathways and reinforce healthier patterns. If you’re looking to rewire your brain at a deeper level, explore our neuroscience-based approach: Rewire Your Brain for Wealth.

The Power of Positive Psychology in Money Management

While most financial advice focuses on cutting costs or increasing income, positive psychology dives into the emotional side of success: mindset, purpose, and resilience. This approach can dramatically shift how you view—and manage—money.

Here’s how positive psychology principles help build long-term financial health:

- Hope & Confidence: Believing you can change your financial future boosts follow-through and decision quality.

- Meaningful goals: Purpose-driven budgeting leads to higher satisfaction and less burnout.

- Visualization: Seeing your ideal financial future increases motivation and focus.

- Positive reinforcement: Celebrate wins—no matter how small—to build momentum and joy in the process.

Positive psychology isn’t toxic positivity. It acknowledges challenges while cultivating optimism, clarity, and forward-thinking. When you anchor your financial choices in values and long-term vision, your money habits become sustainable, not restrictive.

Pair this mindset with practical strategies using our Budgeting Guide—a perfect complement to intentional living and financial alignment.

Smart Tools to Manage Expenses and Improve Financial Health

Changing your financial mindset is powerful—but tools keep you consistent. The right financial tools create structure, reduce overwhelm, and reinforce your goals. They turn intention into habit.

Here are top tools to support better money management:

- EveryDollar: A user-friendly budgeting app based on zero-based budgeting principles.

- YNAB (You Need a Budget): A top-rated tool for goal-setting, cash-flow control, and mindset retraining.

- Qapital or Digit: Automated savings apps that help you save effortlessly toward financial milestones.

- Spending audits: Monthly audits ensure your budget aligns with your actual values—not emotional triggers.

- Financial coaching: One-on-one guidance from certified coaches adds accountability and clarity. Especially helpful when tackling debt or scaling wealth.

Using the right mix of tools doesn’t just save time—it builds discipline and trust in your process. Combine these with a solid budgeting foundation from our in-depth guide: Step-by-Step Budgeting.

Emergency Fund Psychology: Why It Matters More Than You Think

Emergency funds aren’t just about math—they’re about mental security. Without a financial buffer, your brain operates in survival mode, increasing anxiety and impulsive money decisions. A well-funded emergency account reduces stress, improves clarity, and allows long-term thinking.

Behavioral finance research shows that financial uncertainty triggers fear-based behaviors like overspending, hoarding, or avoidance. With an emergency fund, your brain perceives “safety,” giving you permission to stick to your goals even during unexpected setbacks.

Here’s how to make it actionable:

- Start with a micro goal: Save $500 to $1,000 as a starter emergency fund.

- Then aim for 3–6 months of core living expenses, stored in a high-yield savings account.

- Train your mindset: View this fund as peace-of-mind insurance, not money to touch.

For a full guide on building the right emergency savings cushion for your lifestyle, see: How Much Should You Really Keep in Your Emergency Fund?

Budgeting Automation and the Neuroscience of Habit Formation

Your brain loves routine. Automating your finances taps into the science of habit loops—repetition creates default behavior, reducing stress and willpower fatigue. By putting your money on autopilot, you eliminate friction and ensure consistency in budgeting and saving.

Here’s what to automate:

- Savings deposits: Auto-transfer a set amount every payday to your emergency fund or retirement account.

- Bill payments: Eliminate late fees and cognitive clutter with auto-bill pay on essentials.

- Investments: Use platforms that allow recurring deposits into IRAs or brokerage accounts.

When systems run automatically, you free up mental bandwidth. You also reduce the likelihood of emotional sabotage, which often creeps in when decisions are made in the moment.

Want to dig deeper into brain-based wealth-building? Learn how neuroscience can rewire your financial future: Rewire Your Brain for Wealth.

Accountability and Financial Identity Tracking

Change doesn’t stick without accountability. Whether you’re budgeting, saving, or tackling debt, your progress accelerates when someone—or something—is tracking it. Beyond numbers, it’s about identity: becoming someone who sees themselves as financially capable, confident, and consistent.

Here are practical accountability systems to reinforce your progress:

- Money dates: Weekly or bi-weekly check-ins (solo or with a partner) to review spending, goals, and mindset.

- Journaling: Reflect on financial wins, struggles, and thoughts. This builds self-awareness and rewires beliefs.

- Trackers and dashboards: Use apps or spreadsheets to visualize savings goals or debt payoff.

- Accountability partners or financial coaches: External support increases follow-through dramatically.

The more you track and reinforce your identity as a financially capable person, the more effortless better decisions become. Combine these methods with smart debt strategies to accelerate momentum: Debt Snowball vs. Avalanche.

Common Psychological Traps That Sabotage Your Finances

Even financially savvy individuals fall prey to subtle mental traps. These psychological biases often operate unconsciously, sabotaging long-term progress. The key is to bring them into awareness and create systems that help override them.

Here are a few of the most common traps:

- Loss Aversion: We fear losses more than we value gains—making us hold onto bad investments or avoid necessary spending.

- Confirmation Bias: We seek information that validates existing beliefs, even if they’re outdated (like “debt is normal”).

- Present Bias: We prioritize immediate rewards over long-term gains—leading to impulse buys or skipped savings.

- Sunk Cost Fallacy: We keep spending on things we’ve already invested in emotionally or financially, even if it’s no longer serving us.

The fix? Awareness, automation, and decision filters. Build space between impulse and action, and you’ll rewire these behaviors over time.

Rebuilding After Financial Setbacks: A Mindset-First Approach

Financial recovery isn’t just about numbers—it’s about narrative. Whether you’ve faced job loss, credit damage, or medical debt, how you think about your situation determines how quickly (and sustainably) you bounce back.

Here’s how to reframe your setback:

- Shift from shame to strategy: Your past doesn’t define you—it informs your next move.

- Start small: Micro-wins like a $250 emergency buffer or one bill paid down rewire self-trust.

- Practice self-compassion: Progress > perfection. Speak to yourself like you would a friend.

Don’t just repair—rebuild with smarter systems, like budget-first planning and habit-based debt reduction. For tools to strengthen your credit story, see 10 Proven Strategies to Rebuild Credit.

Final Thoughts: Financial Empowerment Starts from Within

True financial freedom isn’t just about wealth—it’s about alignment. When your mindset, habits, and values are aligned, money becomes a tool for possibility—not a source of anxiety or guilt.

The journey starts with awareness. Then comes education, structure, and most of all—intentionality. You don’t need to overhaul everything today. Just shift one habit, rewrite one belief, or automate one savings transfer. Stack these small wins, and momentum builds itself.

Ready to level up? Revisit these core tools to deepen your transformation:

- 7 Money Beliefs That Keep You Broke (and How to Break Them)

- How to Create a Zero-Based Budget

- Side Hustles to Build Financial Buffer

Transformation starts with one shift. Let this be yours.

Top 5 Frequently Asked Questions

1. What is the psychology of money?

The psychology of money refers to the emotional, cognitive, and behavioral influences that shape how individuals manage finances, make decisions, and build wealth. Understanding it helps improve habits and reduce emotional spending.

2. How does childhood impact your money mindset?

Childhood experiences lay the foundation for your money beliefs. Whether you observed scarcity, stress, or abundance, those patterns often shape your adult relationship with saving, spending, and risk-taking.

3. How do I identify my money mindset?

Begin by observing your financial patterns, emotional triggers around money, and the beliefs you hold (e.g., “money is hard to earn” or “I’m bad with money”). Journaling, therapy, or self-assessments can help uncover hidden scripts.

4. Can financial habits really be changed?

Yes—financial behaviors are deeply habitual but highly adaptable. With consistent action, mindset work, and tools like automation, you can build new habits that support long-term goals.

5. What tools can help me change my money behavior?

Apps like YNAB or EveryDollar, habit trackers, automated savings tools like Digit, and financial coaching are effective tools for changing money behavior. Combine them with mindset strategies for best results.