Step-by-Step Budgeting: How to Build a Budget That Actually Works

Key Takeaways

- Budgeting is the cornerstone of financial health, helping you align spending with personal goals and values.

- A well-structured budget plan enables you to pay off debt, build savings, and prepare for the unexpected.

- Using tools like Mint, YNAB, and EveryDollar simplifies the process and improves consistency.

- Emergency funds are non-negotiable for financial resilience—start with $1,000 and grow from there.

- Budgeting isn’t restrictive—it’s the path to financial freedom and conscious decision-making.

Why Budgeting Is the Foundation of Financial Success

Whether you’re trying to eliminate debt, build an emergency fund, or simply stop living paycheck to paycheck, budgeting is your first and most critical step. It’s not just a spreadsheet—it’s a strategy. By taking intentional control of how you earn, spend, save, and invest, you lay the groundwork for every future financial milestone.

According to a 2023 report by CNBC, over 70% of Americans don’t use a detailed monthly budget—yet those who do are significantly more likely to achieve financial goals faster and avoid debt spirals.

Budgeting gives you the ability to:

- Plan ahead for large purchases

- Cut down financial stress

- Grow savings and retirement funds steadily

- Make value-aligned financial decisions

When you understand and manage your money flow, you unlock financial clarity—and that’s the true starting point of freedom.

What Is a Budget? Understanding Its Purpose and Power

A budget is more than a list of numbers—it’s a mission statement for your money. It’s a plan that defines how you’ll allocate your income to cover your needs, reach your goals, and protect your financial future. It brings structure and predictability to what can often feel like chaos.

At its core, budgeting is about cash flow management—tracking what comes in and what goes out. A thoughtful budget ensures you’re not spending emotionally or reactively, but intentionally and strategically. Every dollar is told where to go rather than being spent without purpose.

Common components of a personal budget include:

- After-tax income: Your real take-home pay

- Fixed expenses: Rent, mortgage, insurance

- Variable costs: Utilities, food, fuel

- Discretionary spending: Entertainment, dining out

- Savings and investments: 401(k), IRAs, sinking funds

A good budget doesn’t just help you spend less—it helps you spend better. It empowers you to say yes to what truly matters and no to what doesn’t serve your goals.

Psychology of Money: Why We Overspend and How to Stop

Understanding the psychology of spending is crucial for mastering your budget. Emotional triggers, social pressure, and even brain chemistry can influence how we manage money—often leading to overspending or impulsive financial decisions.

Here are some common behavioral traps:

- Emotional spending: Shopping to relieve stress or boost mood

- Anchoring bias: Making spending decisions based on irrelevant price references

- Instant gratification: Prioritizing short-term pleasure over long-term goals

- Social comparison: Trying to keep up with peers or social media portrayals

To combat these, implement strategies like:

- Setting spending triggers (e.g., “wait 24 hours before purchases over $50”)

- Using cash envelopes for high-risk categories

- Building visual goals (vision boards or savings trackers)

- Automating savings before spending

Budgeting isn’t just about math—it’s about mindset. The more aware you are of the emotional and cognitive biases at play, the easier it is to budget with clarity and intention.

Benefits of Budgeting: Beyond the Numbers

Budgeting isn’t just a tool—it’s a transformational habit that enhances your financial, emotional, and even physical well-being. While the numbers matter, the impact of budgeting goes far beyond dollars and cents.

Key benefits include:

- Reduced anxiety: Financial uncertainty is a leading cause of stress—budgeting provides structure and peace of mind.

- Improved relationships: Money fights are the #1 predictor of divorce. Transparent budgeting fosters communication and teamwork.

- Increased confidence: Seeing your debt drop or savings grow builds motivation and belief in your financial journey.

- Greater flexibility: With a budget, you’re prepared for emergencies and can seize unexpected opportunities (like investing or travel).

Think of budgeting as a life skill, not a financial restriction. When done well, it fuels purpose, autonomy, and resilience.

How Budgeting Empowers You: From Debt to Wealth

At every income level, a budget empowers you to take control. It’s how you stop reacting to money and start directing it. Without a plan, it’s easy to drift into debt, miss savings goals, or live paycheck to paycheck. But with a budget? You gain power, clarity, and traction.

Here’s how budgeting transforms your financial path:

- Stops debt in its tracks: You’ll know exactly how much you can allocate to high-interest debt payments each month.

- Creates room to save: Even small savings ($25/week) build momentum and habits that grow over time.

- Aligns your money with your values: You begin to spend with intention, not obligation or impulse.

- Establishes a future-forward mindset: You shift focus from surviving the now to building what’s next.

Budgeting is not about limitation. It’s about liberation—freeing your time, money, and mind for the things that matter most.

Popular Budgeting Methods (Zero-Based, 50/30/20, Envelope)

No single budget style fits everyone. The key is finding a method that aligns with your mindset, lifestyle, and financial goals. Here are three of the most effective and widely-used budgeting strategies:

Zero-Based Budgeting (ZBB)

Every dollar has a job. At the start of the month, you assign every dollar of income to specific categories—expenses, savings, debt repayment—until there’s zero left unallocated.

- Excellent for detail-oriented planners

- Ideal if you want maximum control

- Learn more: ZBB Explained

50/30/20 Rule

This simplified method divides your income into three broad categories:

- 50% for needs (housing, food, insurance)

- 30% for wants (entertainment, travel)

- 20% for savings and debt repayment

Great for beginners who want a quick-start framework.

Envelope System

This cash-based system involves setting spending limits by category and putting that amount into physical envelopes. When the envelope is empty, you stop spending.

Highly effective for reducing overspending in discretionary categories like dining out or shopping.

Try different systems or even a hybrid approach to find what works best for you.

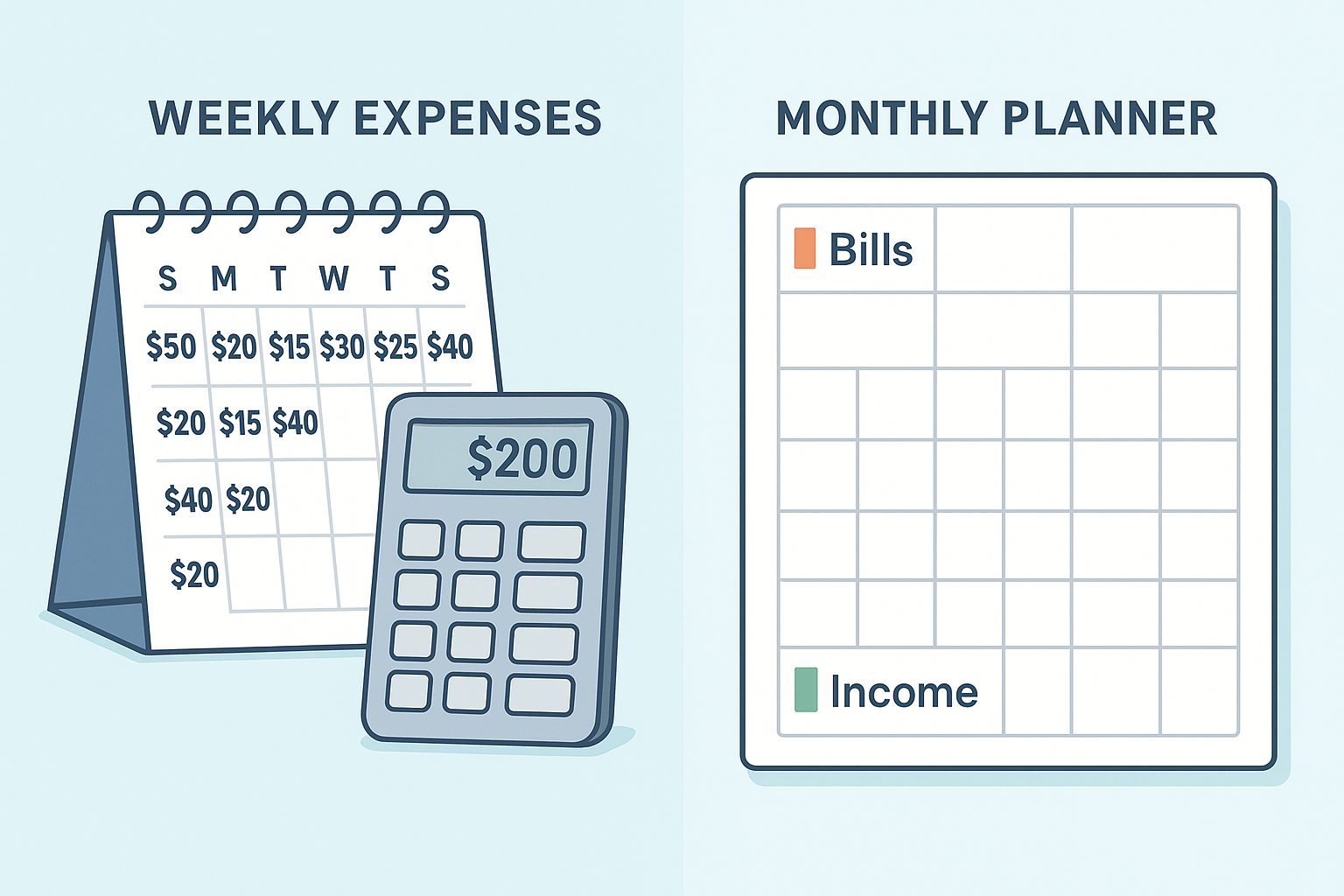

Step-by-Step Guide: How to Create Your First Budget

Getting started can feel overwhelming, but it doesn’t have to be. Follow this step-by-step process to build your first monthly budget:

- Track your current spending for 30 days to establish a baseline

- Calculate your net income (take-home pay after taxes and deductions)

- List all monthly expenses — fixed, variable, and discretionary

- Group expenses into essential (needs) and non-essential (wants)

- Subtract expenses from income to find your surplus or shortfall

- Set goals for savings, debt payoff, and lifestyle upgrades

- Adjust to balance — cut overspending, boost savings

- Choose a tracking system: app, spreadsheet, or printable budget planner

Consistency is key. Even if your first budget isn’t perfect, it’s a critical step in building long-term financial habits.

Essential Budget Categories You Shouldn’t Miss

To make your budget realistic and resilient, you need to include all necessary spending categories—especially the ones people often forget. Here’s a comprehensive breakdown:

Core Budget Categories

- Housing: Rent or mortgage, property taxes, maintenance

- Utilities: Electricity, water, internet, phone

- Transportation: Fuel, car payment, insurance, transit

- Groceries/Food: Groceries, takeout, meal subscriptions

- Insurance & Healthcare: Premiums, copays, prescriptions

- Debt Payments: Credit cards, student loans, personal loans

- Savings & Investments: Emergency fund, 401(k), brokerage

- Personal Expenses: Clothes, haircuts, subscriptions

- Entertainment: Hobbies, streaming services, outings

- Giving: Charitable donations, tithes, gifts

For long-term success, revisit and refine these categories monthly. Life changes, and so should your budget.

Budgeting Tools, Apps, and Templates to Simplify the Process

Whether you’re a tech-savvy planner or prefer pencil-and-paper, there’s a budgeting tool to fit your style. These tools help automate calculations, visualize spending, and ensure consistency over time.

Top Budgeting Apps

- Mint – Best free all-in-one app for beginners. Syncs to your bank accounts for real-time tracking.

- YNAB (You Need a Budget) – Great for zero-based budgeting. Teaches you to \”give every dollar a job.\”

- EveryDollar – Built on Dave Ramsey’s principles. Straightforward and goal-focused.

- PocketGuard – Shows what’s “safe to spend” after bills and goals are considered.

- GoodBudget – Digital envelope budgeting for conscious spending.

DIY Options

- Google Sheets or Excel – Best for customization and tracking historical data.

- Printable Budget Templates – Perfect for visual planners and monthly reviews.

Whichever tool you choose, the goal is consistency. You’re not just managing numbers—you’re managing decisions.

Emergency Funds: Your First Line of Financial Defense

Before you save for retirement or invest in stocks, you need a financial safety net: the emergency fund. Life is unpredictable, and this fund protects your budget from being derailed by car repairs, medical bills, or job loss.

How Much Should You Save?

- Start with $500–$1,000 as a beginner goal

- Build up to 3–6 months of living expenses

- Store it in a high-yield savings account (easy to access, not too easy to spend)

Emergency Fund Benefits

- Prevents reliance on credit cards during unexpected situations

- Maintains your budget’s integrity by covering one-off expenses

- Reduces financial anxiety and increases decision-making confidence

Prioritize this fund early—it gives you the flexibility to keep moving forward when life throws curveballs.

How to Adjust Your Budget Without Giving Up Your Lifestyle

Budgeting doesn’t mean living like a monk—it means prioritizing your values. You don’t have to cut out every coffee or vacation. Instead, refine your budget when necessary without sacrificing joy.

Strategies for Smart Adjustments

- Trim, don’t slash: Cut 10% across categories instead of eliminating one entirely

- Find no-spend alternatives: Movie night at home vs. going out

- Rotate luxury spends: Enjoy treats in moderation rather than eliminating them

- Batch spending: Set one weekend per month for shopping or outings

When to Revisit Your Budget

- After any life event: Job change, new baby, move

- When you notice recurring overspending

- Quarterly for big-picture strategy shifts

Think of your budget as a living document. It should evolve with your life—not restrict it.

Automation: The Secret Weapon for Budgeting Success

One of the most powerful (and underused) budget hacks is automation. By setting up systems to handle repetitive financial tasks, you reduce the risk of missed payments, overspending, and decision fatigue.

What Should You Automate?

- Bill Payments: Utilities, rent, subscriptions, minimum debt payments

- Savings Contributions: Direct deposit to emergency fund or savings account

- Retirement Investing: 401(k) or IRA transfers

- Credit Card Payments: To avoid late fees and interest

Why It Works

- Keeps you consistent with less effort

- Removes temptation to skip saving or overspend

- Builds wealth on autopilot

Set-it-and-forget-it doesn’t mean neglect. Check in monthly to verify everything’s running smoothly—and adjust as your goals evolve.

Tracking Your Progress and Staying Accountable

Creating a budget is only half the battle—tracking your progress ensures you’re staying on course. It’s how you stay motivated, identify trends, and fine-tune your financial decisions.

Tracking Tactics That Work

- Use budgeting apps or spreadsheets to categorize and monitor expenses

- Review transactions weekly to prevent overspending from snowballing

- Set milestone goals: e.g., “Save $500 in 2 months” or “Track expenses for 90 days”

- Celebrate progress: Give yourself a small reward for hitting goals

Accountability Methods

- Money dates: Weekly or monthly check-ins with your partner or yourself

- Accountability partners: Share goals with a trusted friend, mentor, or financial coach

- Financial journaling: Write down thoughts, feelings, and decisions to uncover patterns

The goal is forward momentum, not perfection. Progress—even slow—is what leads to long-term financial change.

Common Budgeting Mistakes (and How to Avoid Them)

Budgeting is a skill—and like any skill, it improves with practice. To accelerate your growth, steer clear of these common mistakes:

Top Budgeting Pitfalls

- Underestimating expenses: Forgetting annual fees, irregular bills, or lifestyle creep

- Not adjusting your budget: Life changes, and so should your budget

- Overcomplicating the process: Simplicity = sustainability

- Budgeting too tightly: No room for fun means you’re more likely to give up

- Failing to track progress: A static budget becomes irrelevant fast

How to Avoid Them

- Build in a buffer category for unexpected expenses

- Review and update monthly

- Keep your system easy and enjoyable

- Include a “fun money” line to prevent burnout

- Use templates, apps, and reminders to stay on top

Remember: A budget isn’t a rigid rulebook—it’s a flexible tool. The key is to adjust, refine, and stay consistent over time.

Budgeting for Irregular Income: Freelancers, Creators & Contractors

If your income fluctuates month to month, budgeting can feel especially challenging—but it’s even more essential. Freelancers, gig workers, and self-employed professionals need to plan for volatility while maintaining consistency in spending and saving.

Tips for Variable Income Budgeting

- Base your budget on your lowest income month in the last 12 months

- Separate personal and business finances to avoid confusion

- Create a buffer fund to cover low-income months

- Use a “two-month lag” approach: Only spend what you earned two months ago

Stability is possible with strategy. Budgeting gives freelancers the control to ride income waves with confidence—not anxiety.

Scaling Your Budget to Build Wealth and Reach Life Goals

Once your budget is in place and your financial foundation is stable, it’s time to scale. Budgeting isn’t just for getting by—it’s the tool you use to get ahead.

How to Scale Your Budget

- Increase savings contributions as your income grows

- Automate investing through index funds, IRAs, or employer-sponsored plans

- Allocate money toward life goals: travel, home purchase, starting a business

- Use surplus funds strategically: Pay down debt faster, build a Roth IRA, invest in courses

Your budget becomes your wealth-building engine—refined over time, optimized for growth, and tailored to your unique life vision.

Case Studies: Real People, Real Budgets, Real Results

Sometimes the best way to understand the power of budgeting is to see it in action. Here are three mini case studies showing how real people used budgeting to change their financial trajectory:

Case 1: Alex – The Indebted Teacher

Alex, a 32-year-old high school teacher, was carrying $12,000 in credit card debt. Using YNAB and a zero-based budget, he prioritized minimum payments, automated savings, and cut dining out by 50%.

- Paid off all credit card debt in 15 months

- Built a $3,500 emergency fund

- Now invests $300/month into a Roth IRA

Case 2: Jamie – The Freelancer with Feast-or-Famine Cycles

Jamie, a freelance designer, built her budget around her lowest-earning month. She opened a buffer account, tracked spending using Mint, and set fixed percentages for savings and taxes each time she got paid.

- No longer relies on credit cards during slow months

- Maintains a $6K buffer fund

- Started funding her SEP IRA quarterly

Case 3: Marcus & Tia – Young Couple Saving for a Home

This newlywed couple set a goal of saving $20K in 12 months. They used the 50/30/20 rule, automated savings to a joint account, and tracked all discretionary expenses using a spreadsheet.

- Met their $20K goal in 10 months

- Stayed under budget on their wedding

- Now using a hybrid envelope + digital budget system

Budgeting isn’t theory—it’s action. And these stories prove that your next financial chapter can be your best one yet.

Final Thoughts: Building a Life of Financial Freedom on Purpose

Budgeting is not about deprivation—it’s about empowerment. It’s how you tell your money where to go instead of wondering where it went. It’s your roadmap to freedom, your protection against chaos, and your permission to dream bigger.

Whether you’re starting from scratch or fine-tuning your plan, the most important step is the next one. Don’t aim for perfection—aim for progress. One month, one category, one small win at a time.

“A budget is telling your money where to go instead of wondering where it went.” – Dave Ramsey

Your future is worth budgeting for. Let’s build it—intentionally, sustainably, and powerfully.

Frequently Asked Questions

1. What’s the 50/30/20 budgeting rule?

It’s a simple budgeting method where 50% of your income goes to needs, 30% to wants, and 20% to savings and debt repayment.

2. How do I create a budget with inconsistent income?

Base your budget on your lowest earning month, build a buffer, and use a “two-month lag” system to smooth out volatility.

3. Can budgeting help me get out of debt?

Absolutely. A good budget helps you prioritize debt payments, avoid new debt, and track your payoff progress over time.

4. What’s the best budgeting app for beginners?

Mint is a great free option for beginners. If you want a more proactive system, try YNAB (You Need A Budget).

5. How do I budget for unexpected expenses?

Build an emergency fund and add a “miscellaneous” category to your monthly budget to create built-in flexibility.