How to Build an Emergency Fund on Minimum Wage (Step-by-Step)

Introduction: Yes, You Can Save on a Low Income

Living on minimum wage can feel like a financial tightrope — every dollar is accounted for, and saving seems impossible. But building an emergency fund, even if it’s just $5 at a time, is not only possible — it’s essential.

Emergencies don’t wait until you’re ready. A flat tire, medical bill, or missed paycheck can unravel everything. That’s why creating a financial cushion is the first step toward breaking the paycheck-to-paycheck cycle. This guide shows exactly how to do it — even on the tightest budget.

Why an Emergency Fund Matters — Especially If You’re Earning Minimum Wage

What Is an Emergency Fund?

An emergency fund is a dedicated savings buffer for unexpected expenses — car repairs, medical bills, job loss, or urgent travel. It’s your financial safety net, designed to keep you from falling into debt when life throws you a curveball.

The Psychology of Safety and Stability

Even a small emergency fund changes how you feel about money. It reduces anxiety, increases confidence, and provides control in a chaotic situation. Psychologically, it shifts your identity from “barely getting by” to “someone who’s prepared.” That mental shift fuels long-term financial behavior change.

How Even $100 Can Save You From a Crisis

You don’t need $5,000 right away. In fact, starting with just $100 can prevent overdraft fees, late rent, or credit card debt. According to a JPMorgan study, 65% of households could avoid a financial crisis with just $250 in savings.

Start small. Win early. Then build on that success.

Step 1: Track Every Dollar (No Judgment, Just Clarity)

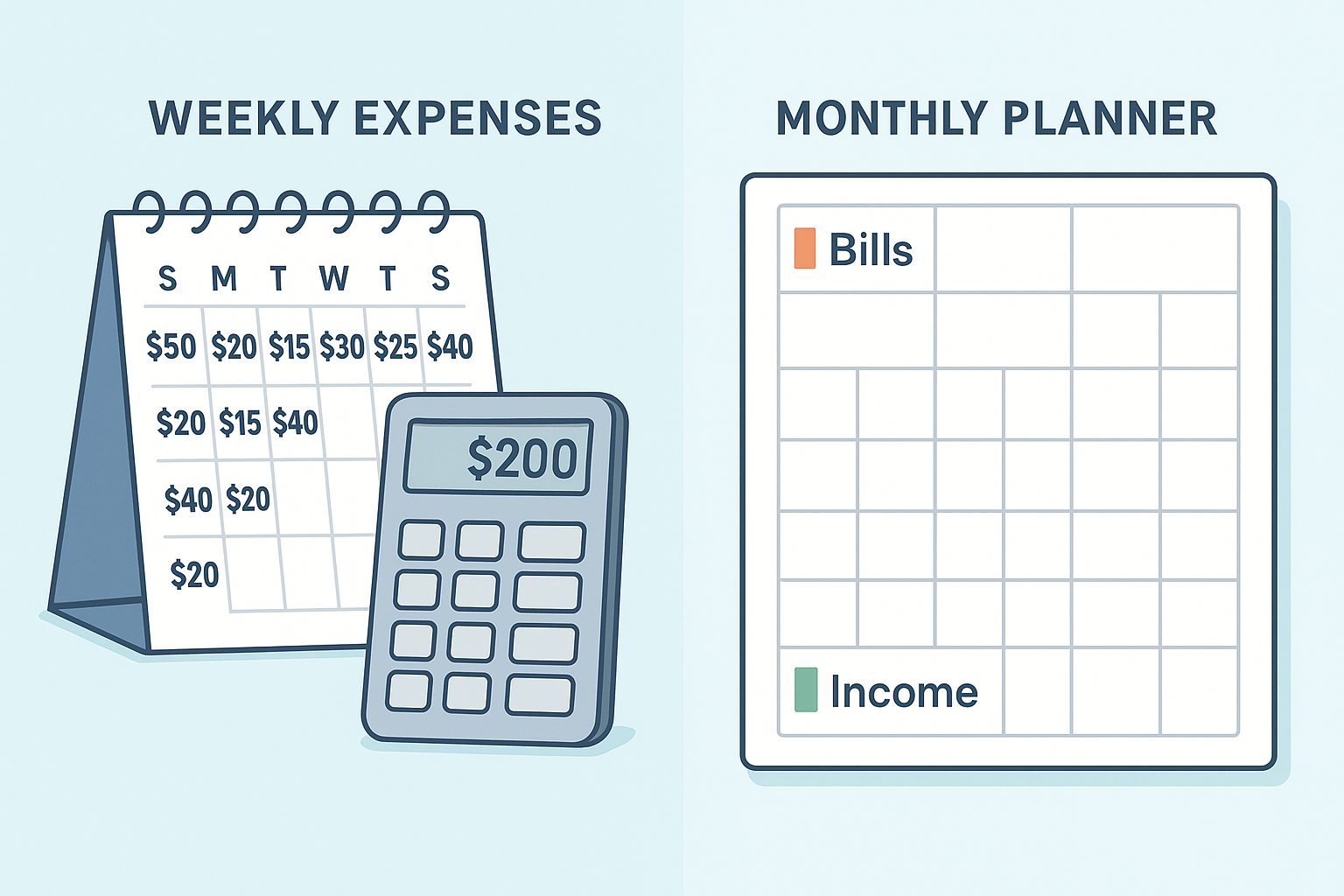

Start With a Zero-Based Budget

A zero-based budget gives every dollar a job — income minus expenses equals zero. It’s not about restriction, but about intention. On minimum wage, knowing exactly where your money goes is critical to creating space for savings.

Check out our full guide: ZBB: How to Create a Zero-Based Budget (and Why It Works).

Use Free Tools and Apps to Track Spending

Use budgeting apps like Mint, YNAB (You Need A Budget), or Google Sheets to log every expense. Seeing your spending in black-and-white often reveals “leaks” — small, frequent purchases that add up fast.

Plugging those leaks might free up $10–$50/month to seed your emergency fund.

Step 2: Build a Mini Buffer First ($100–$500)

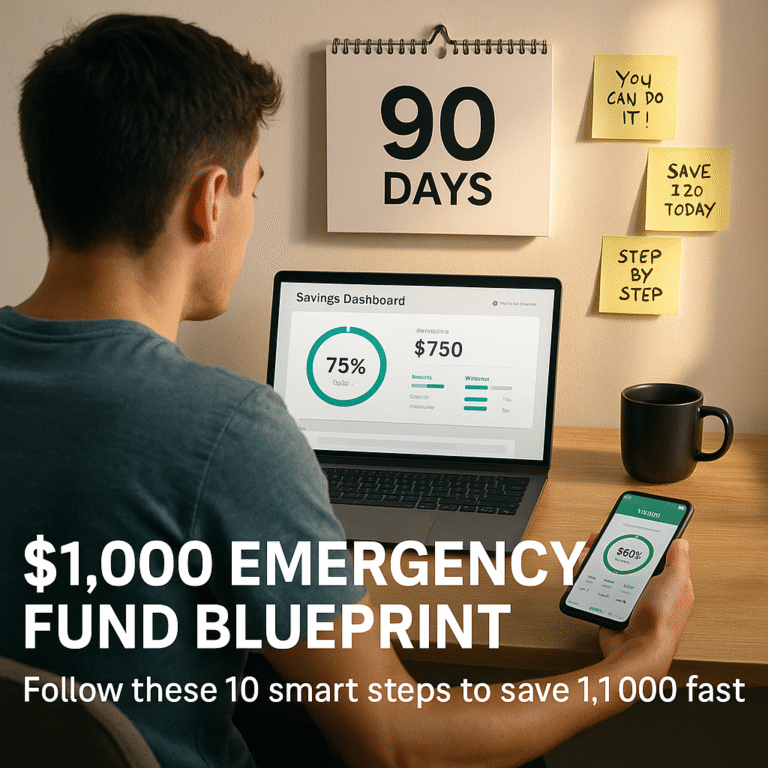

Why a Small Goal Works Better Than a Big One

Big savings goals feel overwhelming. But aiming for $100–$500 feels doable. Psychologically, early wins build momentum. Once you save your first $100, you’ll be more motivated to hit $250, then $500, and beyond.

Cash Envelope Methods and No-Spend Challenges

The envelope method helps control discretionary spending — allocate set amounts for categories like food or gas. When it’s gone, it’s gone. Try a “no-spend weekend” challenge to eliminate impulse purchases and redirect that cash into savings.

Turn Spare Change Into Real Progress (Round-Ups + Apps)

Apps like Acorns and Qapital round up your purchases to the nearest dollar and deposit the difference into savings. If you make 50 purchases a month, you could easily save $25+ without noticing.

Step 3: Make Saving Automatic and Invisible

Set Up Auto-Transfers, Even Just $2 a Day

Automate a small daily or weekly transfer — $2/day equals $60/month. Set it to happen the moment you get paid, before you can spend it. When saving becomes invisible, it becomes consistent.

Use Micro-Saving Tools (Digit, Acorns, Chime)

These apps analyze your spending and move small, safe amounts into savings. Digit is especially effective for low-income savers because it adjusts based on your balance.

Invisible savings add up — quietly, consistently, and without emotional resistance.

Step 4: Increase Your Cash Flow Strategically

Use Side Hustles or Gig Work Without Burnout

Even one extra shift a week or a few hours on apps like TaskRabbit, DoorDash, or Rover can help you save faster. The key is to avoid burnout — treat side gigs as a bridge, not a lifestyle.

Explore: 10 Highest-Paying Side Hustles to Start in 2025.

Sell Unused Items or Offer Local Services

Declutter your home and sell unused items on Facebook Marketplace, Craigslist, or OfferUp. Offer services like tutoring, cleaning, or yard work in your community. Quick cash boosts are perfect for jumpstarting your emergency fund.

Redirect “Found” Money (Bonuses, Tax Refunds)

Any unexpected windfall — a birthday gift, bonus, or refund — is a golden opportunity to pad your fund. Since it’s “extra,” you won’t miss it. Treat 50% of it as non-negotiable savings.

Step 5: Set Visual Goals and Celebrate Milestones

Track Progress Visually With Charts or Jars

Print a savings tracker and color in your progress. Or use a physical jar with visible dollar bills or coins. These visual cues reinforce progress and create daily motivation to keep going.

Use Positive Reinforcement to Sustain Momentum

Celebrate milestones. Hit $100? Treat yourself to a free reward — like a movie night at home. This builds psychological reinforcement and associates saving with positivity, not restriction.

Common Struggles and How to Overcome Them

What If I Can’t Save Every Month?

That’s okay. Life happens. The goal is consistency over time — not perfection. If one month is tight, pause. Just restart when you can. Every dollar saved counts.

How to Rebuild After Using the Fund

If you use your fund for an emergency (great job!), treat rebuilding it like a challenge. Use the same steps again — track, automate, and celebrate each milestone. The muscle is already there. Flex it again.

Conclusion: Building Financial Security One Step at a Time

Saving on minimum wage isn’t easy — but it’s 100% possible. The key is to start small, automate success, and give yourself grace. With the right tools and mindset, you can build a buffer between you and financial stress.

Because peace of mind isn’t a luxury — it’s a necessity. And you deserve it.

FAQs

1. Can you really build an emergency fund on minimum wage?

Yes. While it takes creativity and consistency, building even a small emergency fund is achievable by tracking expenses, automating micro-savings, and using gig income or no-spend challenges.

2. How much should I aim to save if I earn minimum wage?

Start small. Aim for a $100–$500 buffer first. Over time, grow this to 1–3 months of essential expenses.

3. What’s the fastest way to save money on minimum wage?

Automate small daily transfers, track spending closely, and temporarily boost income with side gigs or selling unused items.

4. Are saving apps helpful for low-income earners?

Yes. Apps like Digit, Acorns, and Chime automate savings and round up purchases to help build a fund without extra effort.

5. How do I stop living paycheck to paycheck?

Track your expenses, cut unnecessary costs, set up automatic savings, and create a mini emergency fund to break the cycle.

Additional Resources

- ZBB: How to Create a Zero-Based Budget (and Why It Works)

- How to Start Saving When You’re Broke

- 10 Highest-Paying Side Hustles to Start in 2025

- How Much Should You Save Each Month? A Simple Formula for Any Income

- How Much Should You Keep in Your Emergency Fund?

- How to Break the Cycle of Emotional Spending Triggers

- How to Stop Money Anxiety From Controlling Your Spending

- Qapital – Behavioral Savings App

- Acorns – Round-Up Micro Investing App

- Digit – Smart Automated Savings App